While many of us are struggling to keep track of what day, or even month, it is, the first quarter of 2020 has come and gone. And though the Fisher Real Estate team paused many of its sales and marketing updates during this sensitive time, we know many clients have been eager for an update on the status of the island’s real estate market.

Like many markets, we recognize that it will take time to fully understand the impact current events are having on our local market. We also know that first quarter data largely measures the market prior to any effects from the recent pandemic. With that in mind, this month’s report will not only summarize what we saw in the first quarter, but offer a brief overview of where we are now….

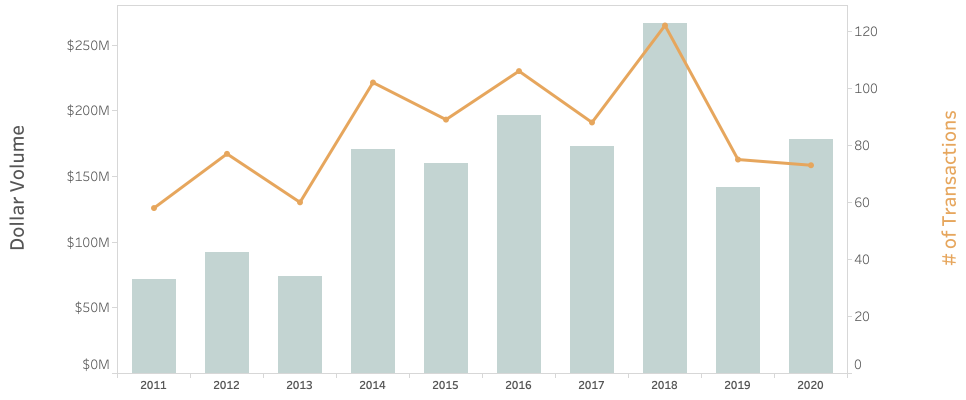

Transaction and Dollar Volume from January 1 – March 31

January 1, 2020 – March 31, 2020

THE MARKET WAS SETTING UP FOR A SOLID FIRST QUARTER

- Total 1Q2020 dollar volume rose 30 percent to $178M from 1Q19 while transaction levels were essentially even at 73 properties.

- January figures were notably buoyed by a $25M waterfront property transaction, while March figures were suppressed due to at least 10 transactions that were scheduled to close but were either delayed, extended or terminated from March 16th through March 31st.

- On March 16th, 2020, the Nantucket Registry of Deeds closed for a little over a week due to concerns over social distancing. Without local capability for electronic recordings, several real estate closings were thrown into limbo. A few transactions managed to close wherein buyers accepted title insurer gap coverage (to cover the period from the time of the closing and the time the deed was formally recorded). At least one transaction did not close during this time as the idea of clear title was challenged given the time delay from closing to deed recording. And a handful of other transactions were postponed due to negotiated extensions.

- On March 25, 2020, the Registry of Deeds reopened on a limited basis, allowing for additional transactions to close. In total, seven transactions closed between March 16, 2020 and March 31, 2020. None of these transactions included any pricing concessions allowing the first quarter to officially serve as the last pricing indicator of pre-COVID events.

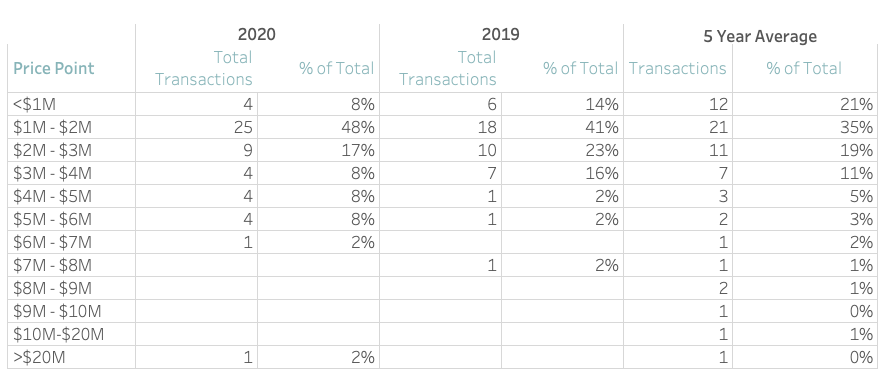

- For single-family homes, the sales by price point distribution shows that transactions in the $1M to $2M segment were 40 percent higher than in 2019. Toward the upper end of the market, there were three fewer transactions in the $3M to $4M segment, but six more transactions in the $4M-$6M segment that what the market witnessed last year. And, of course, there was the one, ultra-high-end transaction. As compared to the five-year average, these upper price point transactions are roughly similar.

Single Family Home Sales by Price Point

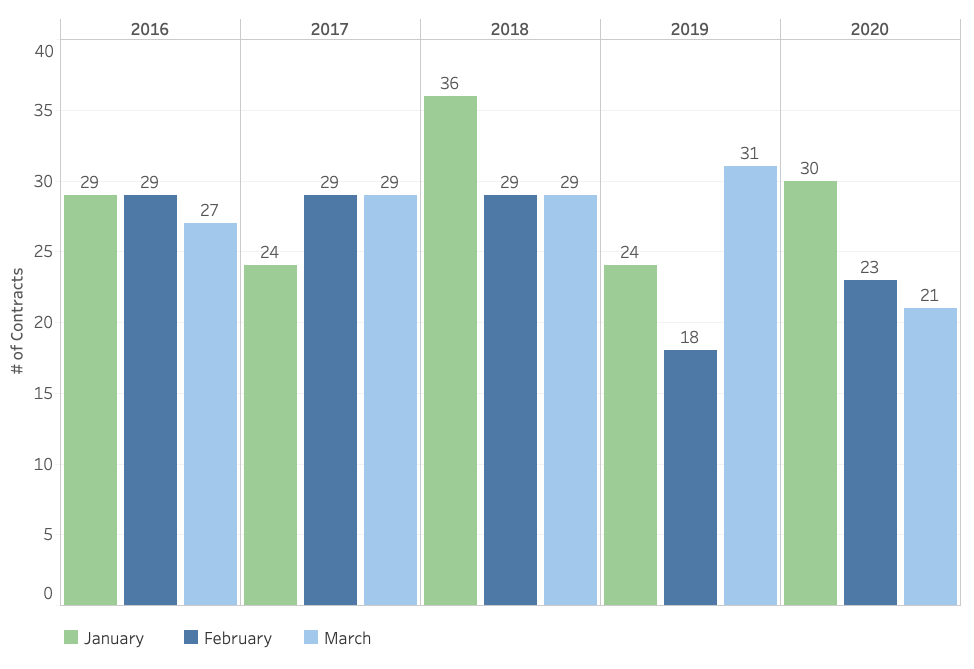

- Prior to mid-March, market activity felt more vibrant than is typical during the first few months of the year. Buyers were traveling to the island on weekends to look at properties and contracts were being recorded at a healthy pace, particularly in January. Cumulative first quarter contract volume totaled 73 transactions, which is identical to what we saw in the first quarter of 2019 but lower than in 1Q18 and 1Q17. For those contracts that were recorded in the MLS, there was more activity in the $2M+ segment than there was in 1Q19. What we don’t really know is how severely new purchase contracts were affected in late February and March. We know of at least a handful of contracts that were terminated but there isn’t much clarity around the total number due to the way contracts aren’t always formally recorded.

Year-to-Date Contract Activity

Post-Mid-March 2020…

WHERE ARE WE NOW?

Does anyone truly know? Sure, we can look to past recessions and market reactions to economic crises and wonder if the market will mimic those declines. (In 2008, we saw a median home sale decline of 34 percent). But, until we really grasp the domino effect of how businesses and individuals are impacted from this pandemic, we really can’t predict what will happen in most real estate markets, let alone Nantucket.

We know that April and May (and possibly beyond) will see severely limited closing, listing and contract activity. This is partially due to the shelter in place order in many locations, but also due to the economic uncertainty we all face and the lack of clarity on how we begin to return to some sort of normal. Added to this is the mortgage forbearance programs being offered by some lenders. That measure could provide a temporary stop-gap to homeowners struggling to pay their notes, or investors grappling with losses in 2020 rental income. It will also likely delay what may be an eventual reset on property values, particularly at the lower end of the market.

We also recognize, based on recent calls and conversations, that there is a strong possibility there will be pent up demand for destinations like Nantucket where access to privacy and open space is easier to come by than in many of our primary buyer demographic markets like Boston, New York and DC. We believe this may be particularly true for the upper end price points. What happens to property values will wholly depend on the balance of the supply of homes and the demand from buyers as we emerge from this crisis. And that will wholly depend on the stability of our financial markets in the near- and long-term.

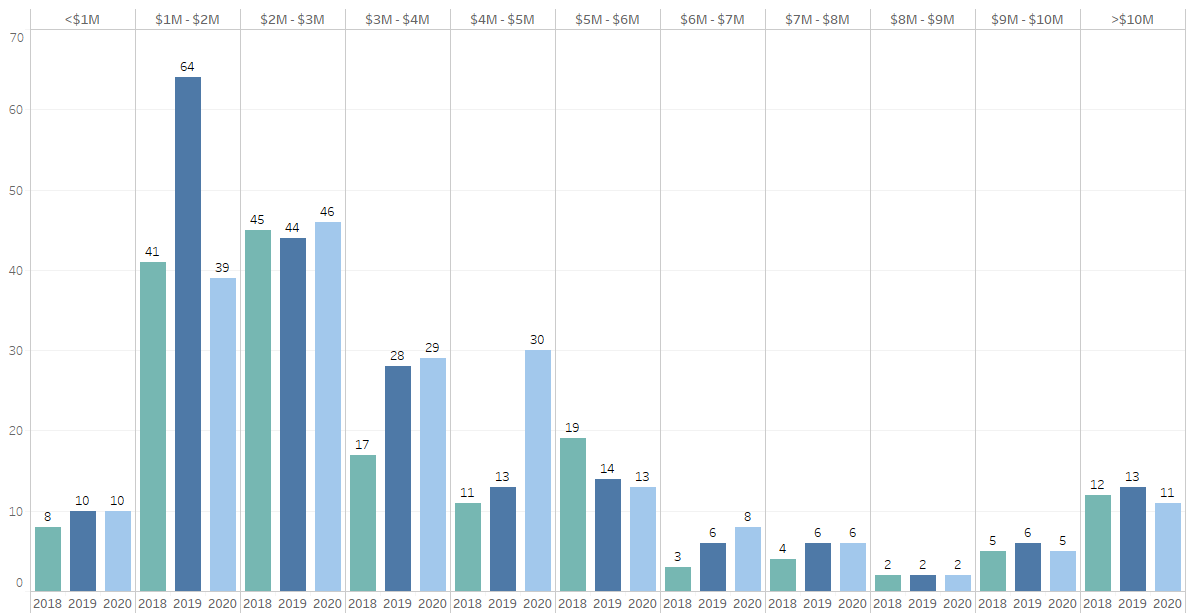

At the end of March, total inventory for all property types was just slightly lower than one year ago, measuring 274 properties. Of this, 198 properties represented single-family homes. Nantucket does not typically see its peak in annual inventory until July of each year. While, even now, some new listings are trickling to the market, many sellers who intended to list in 2020 prior to recent events, are sitting on the sidelines waiting to see what happens so true inventory figures may take some time to be revealed.

Inventory by Price Point

The bottom line is that 2020 will be a dynamic market for our seasonal location. With limited data on everything from COVID testing to transactions, it’s difficult to project where we are headed but you can bet we will be keeping track. If you have any questions, we encourage you to reach out to us. We’d be happy to share our current insights on what is happening in both the sales and rental market.