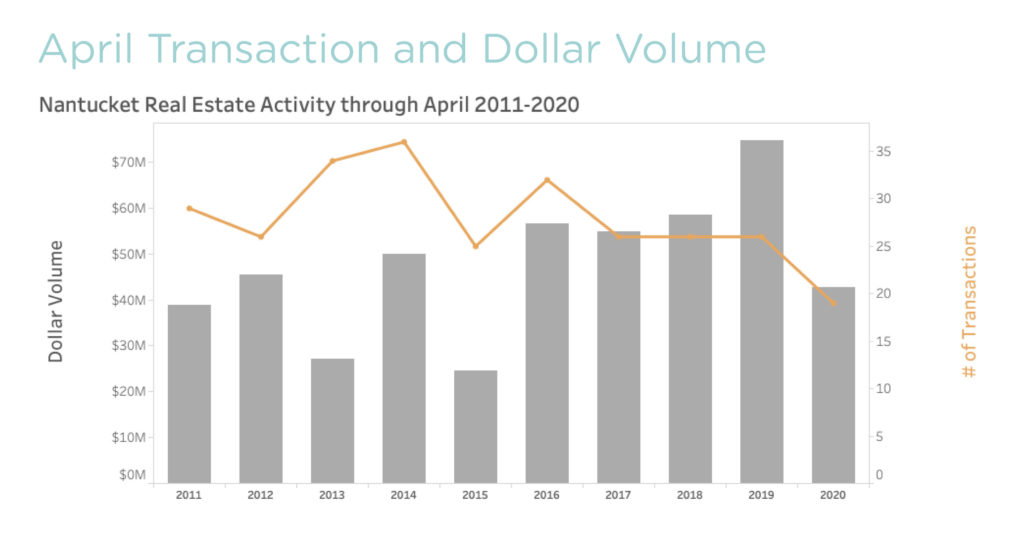

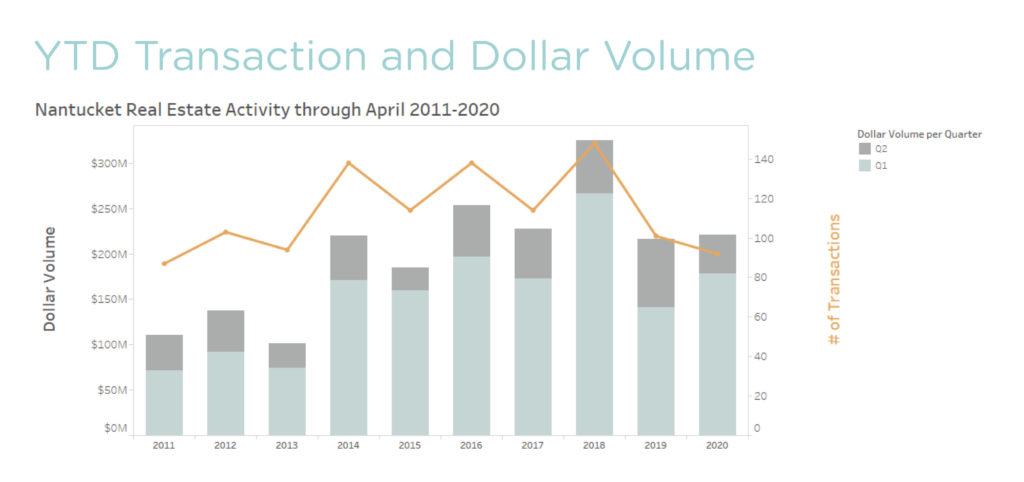

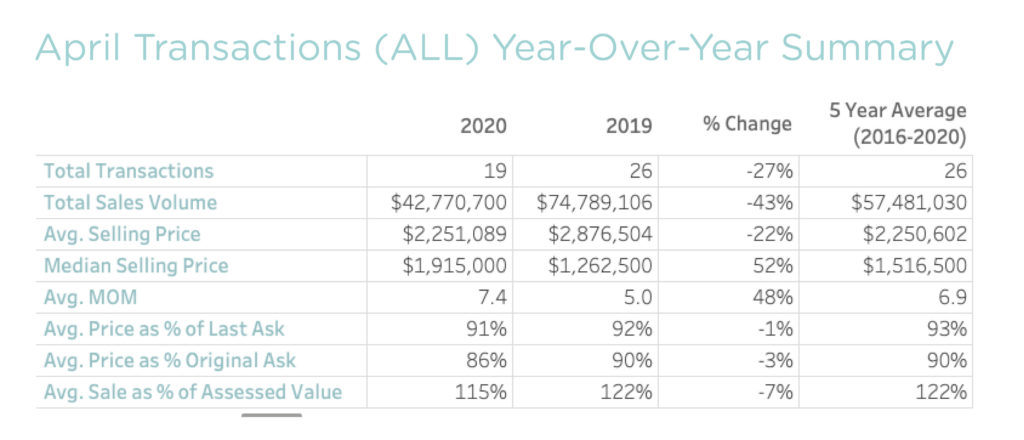

The pronounced pause in Nantucket real estate transaction activity that began in mid-March persisted through April. In total, there were 19 property transfers totaling $42.8 million, a respective decline of 27 percent and 47 percent from March 2019. Year-to-date figures, however, were only off nine percent on a transaction basis and were two percent higher than the same period one year ago thanks to a comparatively strong January and February. Unless there is a pronounced turnaround in market trends (and there has been a glimmer of hope in new purchase activity in May), we suspect the year-over-year transaction and dollar volume comparison will continue to worsen in the near-term.

Similar to March transactions, the majority of the activity that occurred in April represented property sales that were under contract prior to mid-March making it difficult to glean what, if any, property value adjustments might exist in the post-COVID world. April transactions ranged from a $260,000 vacant land sale to a $7.1 million property in Brant Point with an average sale price of 91 percent to the last asking price, slightly lower than the recent year-to-date average. While not reflected as a closing just yet, we do know of at least one property that went under agreement at full asking price in the last two weeks, indicating there is pent up demand for well-priced properties. The property was listed for 100 percent of its assessed value (and just four percent above its 2011 sale price) suggesting a solid concession to pre-COVID pricing. That said, other new contracts appear to be occurring within similar discount ranges to pre-COVID events.

Aside from overall volume, one of the main differences between 2020 and 2019 transaction activity is the lack of commercial sales in 2020. Though this is to be expected considering all the uncertainty within this sector of the market, it’s worth pointing out that during this time last year, there were nine commercial property sales as compared to the three that have taken place thus far in 2020. At least one purchase contract for an in-town commercial property fell apart in recent weeks, while a couple of others are yet to be determined.

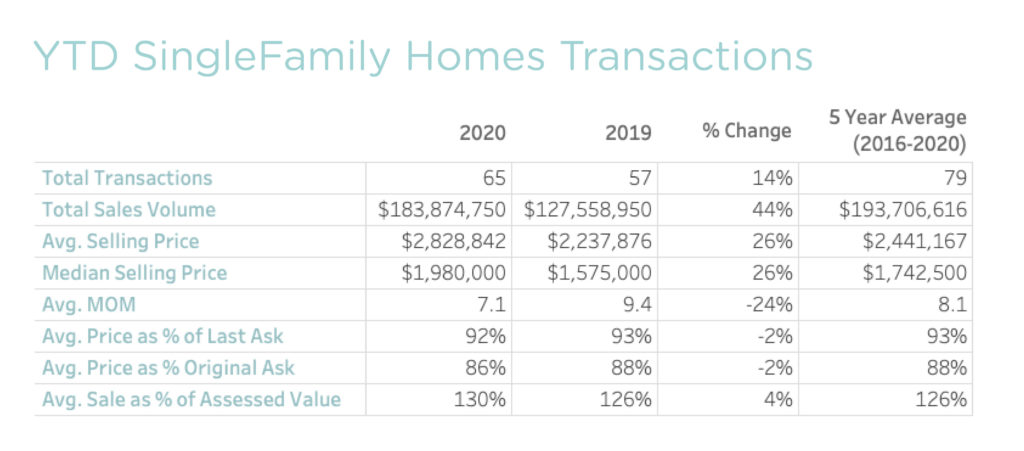

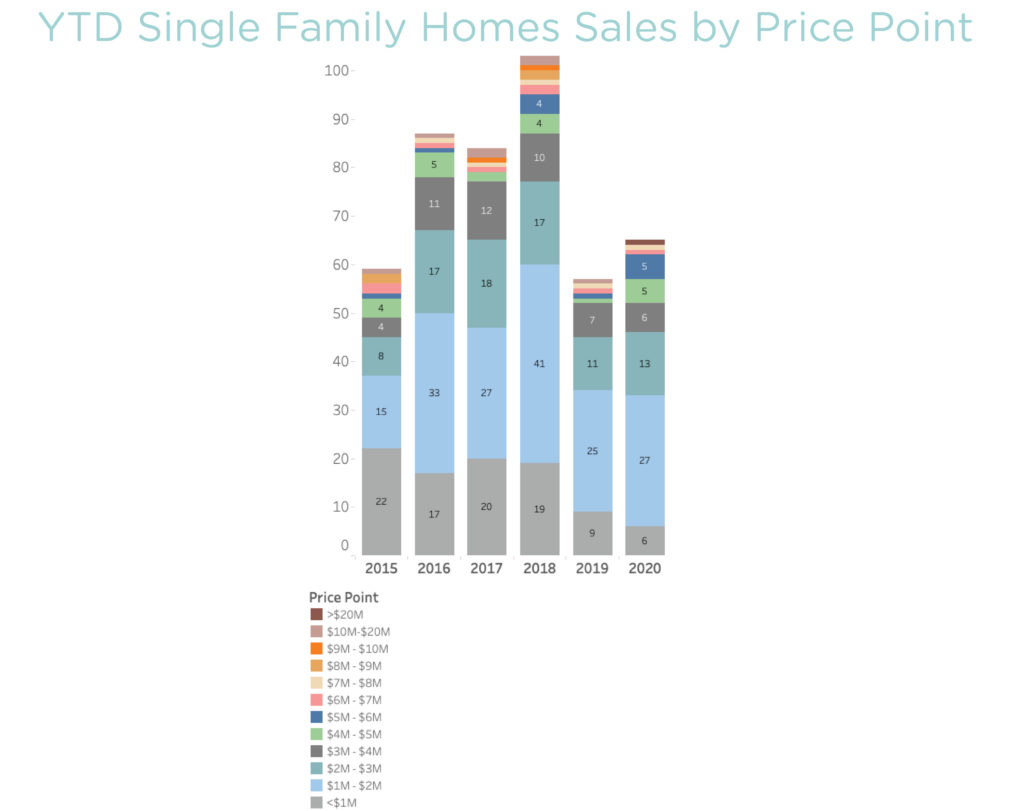

Though commercial property sales were down, single-family home sales increased on a year-over-year basis. Through April 30, 2020, there were 65 single-family home transactions (excluding foreclosures and affordable properties), as compared to 57 properties as of April 30, 2019. The average marketing time was still trending lower at 7.1 months in 2020 as compared to 9.4 months one year ago. Overall, sales by price point showed a similar distribution as in 2019 and the five-year average with the exception in the number of sales less than $1 million, which continued to show a multi-year downward trend.

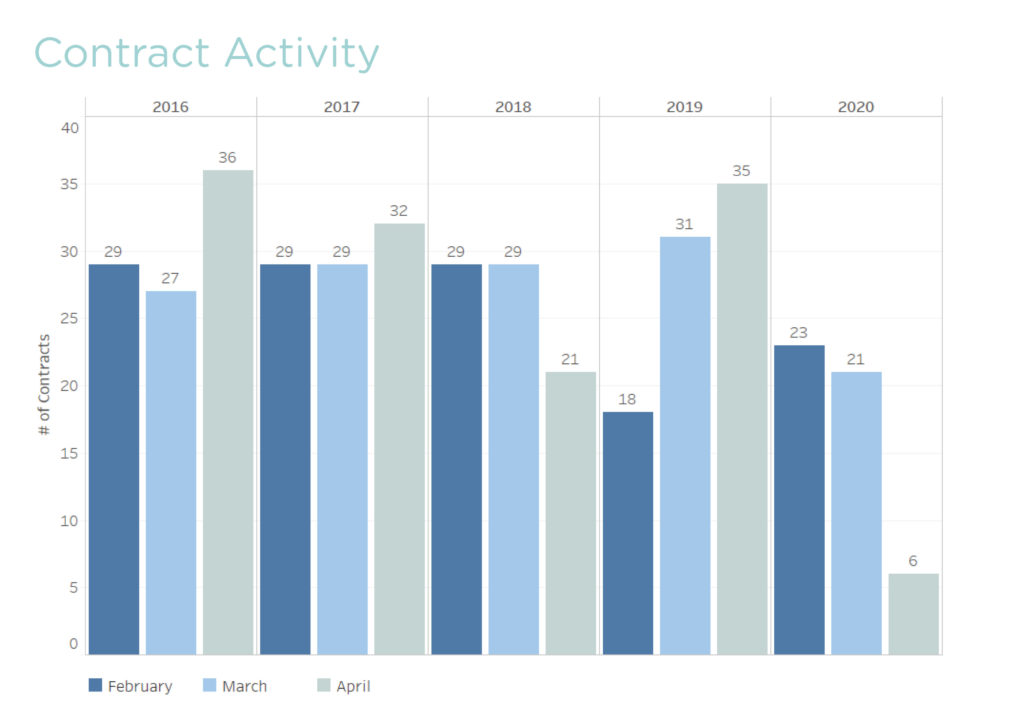

We touched a bit on contract activity in the introduction but, suffice it to say, the market isn’t all that transparent in recent weeks. Wherein there is often a bit of hesitancy on the part of sellers and/or their brokers to mark a property under contract in the MLS until the deal is solid (ie minimal or no outstanding contingencies), there is even more caution now. So, while the contract activity chart shows a dramatic reduction in new purchase contracts recorded in April (35 in April 2019 and only 3 in April 2020), we know anecdotally that there are many more outstanding contracts than what is being reflected in the MLS. Preliminary May activity suggests more MLS contracts will be reflected in our May report but, until then, we will have to rely on the fact that we are hearing the new contract number to be more in the 20 property range.

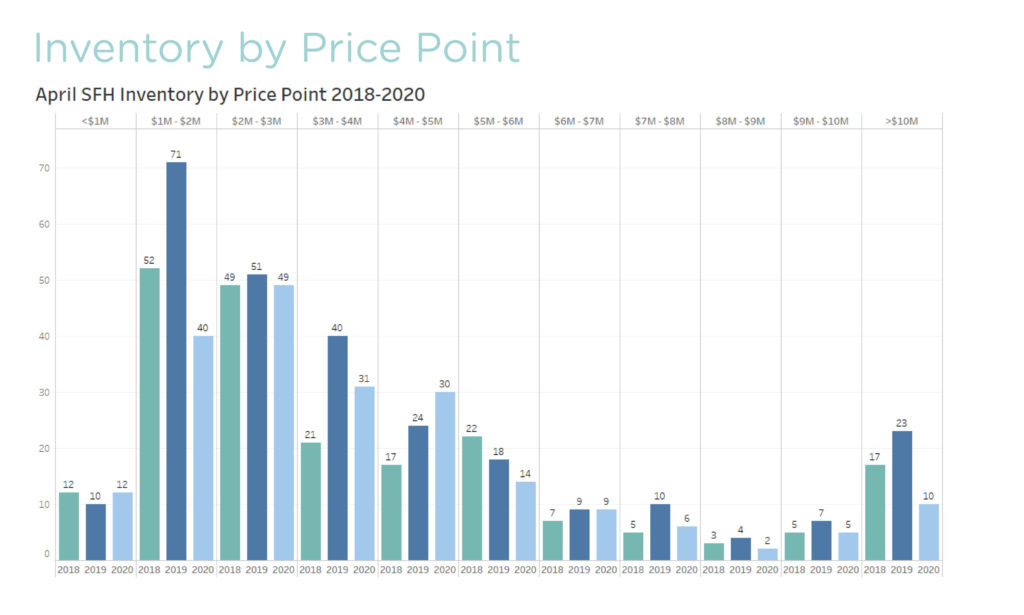

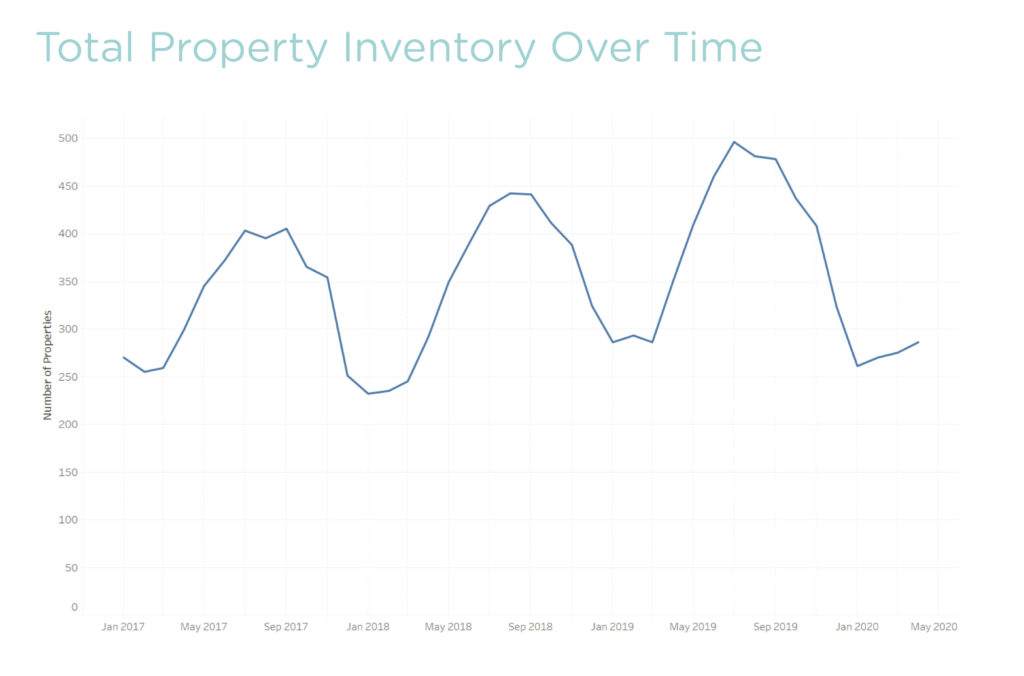

On the property inventory front, the below chart indicates we are likely to see less property inventory this year or, at the very least, a much slower ramp in inventory than in year’s past. It’s too early to tell if this is simply due to a late start given the MA stay-at-home orders or if homeowners are likely to be using their properties this summer and are not going to list the property at all. As of April 30, 2020, there were 284 properties on the market as compared to 348 one year ago. This included 206 single-family homes, 46 land parcels, 17 condo/co-ops/multi-family and 15 commercial properties. The decline is due almost entirely to fewer single-family home properties, which measured 22 percent lower than one year ago. If low inventory persists, this could bode well for property values.

In viewing property inventory by price point, the biggest year-over-year declines in property inventory are in the $1 million to $2 million segments as well as for properties listed for more than $10 million.